Spotlight on Tikehau Impact Credit

The world of high yield credit has, so far, been relatively impregnable against the crashing waves of ESG investment. Not so from summer of this year, when the team at Tikehau launched their `Tikehau Impact Credit` fund*.

Spotlight on: Altana Carbon Futures Opportunity and Carbon Credit Hedge Funds

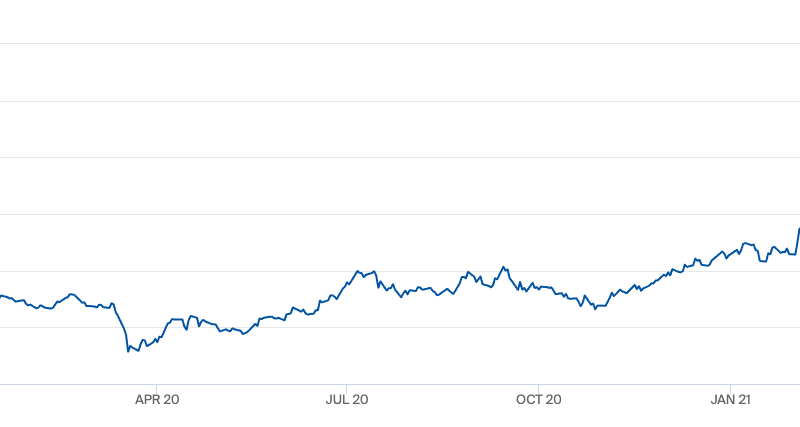

In 2005, as the European Union tried to plot a market-lead but effective path to lower overall emissions, they launched the world’s first major carbon emissions trading scheme .

VOTE ETF: The Launch of the First Passive Aggressive ESG Fund

In May 2021, activist hedge fund Engine No. 1 shot to prominence on the back of its success in winning the shareholder fight with oil giant Exxon Mobil (XOM). The fund was relatively unknown at the time. It was founded in late 2020 by Chris James, a Wall Street veteran who formerly ran Andor Capital Management and Partner Fund Management. The San Francisco-based fund started with about $250 million in assets.

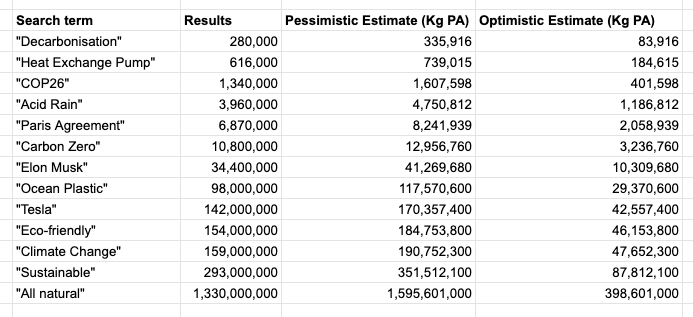

ESTea #17 15/09/2021 The carbon price of bulls***

There’s only one thing worse than greenwashing – green bull****ing.

ESTea #17 02/09/21 Spotlight on: Triodos Pioneer Impact Fund

Triodos have, by far, the clearest commitment to carbon-neutral and ethical investing of any major fund brand. Almost certainly they launched the first ‘Green’ fund back in 1990, only ten years after they were founded and decades before the rest of the market.

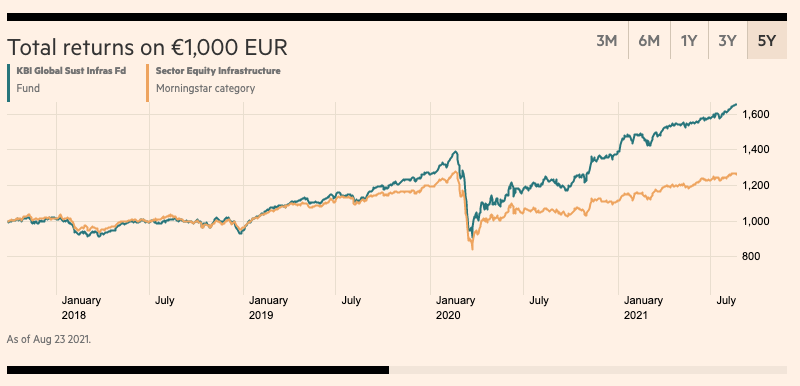

ESTea #15 18/09/21 Spotlight on: KBI Global Sustainable Infrastructure Fund

Since 2017 – long before many of us even heard the phrase ‘ESG’ – Colm O’Conner at KBI has been building the Global Sustainable Infrastructure Fund (GSIF). Now in its fourth year, the fund has great performance, runs under an Article 8 banner and invests in all the companies I wanted to work for when I was a kid…

ESTea #14 23/07/21 – Spotlight on: Eurizon Sustainable Multiasset

Essentially, the Italians do everything better than the rest of the world. It’s hard to admit – but it’s true. Born from the finest Italian Banking pedigree (Intesa Sanpaolo) – Eurizon is a prima donna of asset managers, complete with a virtuoso sustainable manifesto.

ESTea #14 23/07/21 Spotlight on: Generation Investment Management

What if Al Gore chaired a hedge fund dedicated to decarbonising the global economy and averting an ecological tipping point? Oh yeah, he already does that.

ESTea #13 23/07/21: Spotlight on: The Children’s Investment Fund

The Children’s Investment (TCI) Fund is one of the world’s most prominent ESG-concerned hedge funds, and often forms the vanguard of investor activism on ESG issues – especially around the environment and climate change. Despite the fact that they were never established as an activist, nor a climate-change fund – TCI have emerged as a preeminent and highly successful activist fund.